AIF Registration | Alternative Investment Fund Registration

What is an AIF (Alternative Investment Fund)?

Alternative Investment Funds (AIFs) are pooled investment vehicles that channel capital into a diverse range of alternative asset classes. Unlike conventional investment avenues such as equities or debt instruments, AIFs invest in areas like private equity, venture capital, real estate, hedge funds, and managed futures. They serve as a unique platform for high-net-worth and sophisticated investors seeking to diversify their portfolios and explore unconventional investment opportunities. Secure your AIF registration license efficiently and in full compliance with regulatory requirements, with expert assistance ensuring a smooth and seamless application process.

Alternative

Investment Funds (AIFs) are governed and regulated by the Securities

and Exchange Board of India (SEBI) under the SEBI (Alternative

Investment Funds) Regulations, 2012. Unlike mutual funds, AIFs are not

covered under the Mutual Fund Regulations framed by SEBI.

According to Regulation 2(1)(b) of the SEBI (Alternative Investment

Funds) Regulations, 2012, an AIF refers to any fund established or

incorporated in India as a trust, company, limited liability partnership

(LLP), or body corporate. It functions as a privately pooled investment

vehicle that collects funds from investors—whether Indian or

foreign—for investment in accordance with a defined investment policy,

with the objective of generating returns for its investors.

These funds are professionally managed and can be structured as a trust,

company, LLP, or body corporate, in compliance with the applicable

legal and regulatory framework.

AIFs are private pooled investment funds and are not available through the forms of public issues (like Initial Public Offerings), which apply to Mutual Funds or other collective investment Schemes.

Generally, high net worth individuals and institutions invest in AIFs Alternative Investment Funds, as they require a high investment amount, unlike Mutual Funds.

As per the AIF Regulation 2012, an AIF is a fund established in India, whether as a Trust or a Company, or an LLP, which is :

- A privately pooled investment vehicle that pools funds from sophisticated investors and invests in accordance with a defined investment policy to benefit its investors.

- Is not an entity registered under the SEBI (Collective Investment Schemes) Regulations, 1999, OR SEBI (Mutual Funds) Regulations, 1996, OR any other regulations issued by SEBI about pooling of funds or fund management.

Which entities are exempted from the purview of AIF Regulations?

Entities that do not fall under the purview of AIF Regulations

The landscape of financial regulations in India is broad and complex, with various entities operating within specific regulatory frameworks. One such entity is the Alternative Investment Fund (AIF), which is defined and regulated under the SEBI (Alternative Investment Funds registration) Regulations, 2012. As part of these regulations, certain entities are explicitly excluded from being classified as AIFs, and others are granted specific exemptions. Understanding these exceptions is crucial for businesses and individuals who are exploring investment opportunities or considering establishing an AIF. The following discussion provides an elaboration on these entities.

-

Entities covered under other SEBI regulations: AIFs do not include funds that fall under other specific SEBI regulations, namely:

-

SEBI (Mutual Funds) Regulations, 1996: Mutual funds are a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which are managed by an investment company. Mutual funds are covered under their own specific regulations and are not considered AIFs.

-

SEBI (Collective Investment Schemes) Regulations, 1999: Collective Investment Schemes (CIS) are also a type of investment vehicle where funds are pooled from various investors to invest in a portfolio of securities. Like mutual funds, CISs are governed under their own regulations and are excluded from being classified as AIFs.

-

Other SEBI regulations for fund management activities: Other SEBI regulations govern specific types of fund management activities. Funds that are covered under these regulations are also not considered AIFs.

-

-

Exemptions from AIF Registration: Certain entities are granted exemptions from registration under the AIF regulations. These include:

-

Family trusts for the benefit of 'relatives': Family trusts that are set up for the benefit of 'relatives', as defined under the Companies Act, 1956, are exempted from AIF registration. This means that these trusts can operate without having to comply with the AIF regulations.

-

Employee welfare or gratuity trusts: Trusts that are set up for the benefit of employees, including employee welfare trusts and gratuity trusts, are also exempted from AIF registration. These trusts are typically established by companies to provide benefits to their employees.

-

Holding companies: Holding companies, as defined under Section 4 of the Companies Act, 1956, are another category of entities that are exempted from AIF registration. A holding company is a company that owns the stocks of other companies, to control the management and policies of the companies it owns.

-

It's important to note that while these exemptions exist, the applicability of these exemptions depends on the specific circumstances and legal interpretations. Therefore, potential investors and fund managers should seek professional legal and financial advice to understand how these regulations may apply to their specific situations.

What are the benefits of an AIF?

Following are the benefits of Alternative Investment Funds:

-

Greater Flexibility and Scope: AIFs offer greater flexibility and scope compared to traditional investment options. They are not bound by the same kind of investment restrictions that apply to mutual funds, for instance. This means that AIFs can invest in a broad range of assets and adopt innovative investment strategies, offering a variety of options for investors seeking different risk and return profiles.

-

Lucrative Risk-Return Ratio: With the potential for high returns comes higher risk, but many investors find the risk-return ratio offered by AIFs to be very attractive. The ability to invest in non-traditional and less liquid assets, such as private companies or commodities, means that AIFs can potentially offer higher returns than traditional investments.

-

Greater Diversification and Low Correlation: AIFs can invest in a wide array of assets that are not typically included in traditional portfolios, providing a valuable tool for portfolio diversification. Additionally, the returns from these alternative investments often have low correlation with traditional asset classes, which can help reduce portfolio volatility and enhance risk-adjusted returns.

-

Opportunities in Unlisted Companies and High-Yielding Funds: AIFs often provide opportunities to invest in unlisted companies and other high-yielding funds, which are typically inaccessible to regular investors. This gives investors access to potentially lucrative investment opportunities in the private sector, such as early-stage startups, real estate projects, or distressed assets.

-

Structured Products with Ample Risk Mitigation: AIFs often offer structured products that are designed to provide a certain level of risk mitigation, while still offering the potential for substantial returns. These structured products use sophisticated investment strategies and financial instruments to balance risk and return. This makes AIFs particularly attractive to high-net-worth individuals (HNIs) who are seeking diversified exposure to alternative investments while also managing their overall portfolio risk.

Remember, while these benefits can make AIFs a valuable component of a well-diversified portfolio, they also carry risks. As such, investors should thoroughly understand these risks and consult with financial advisors before investing.

What are the pre-requisites for setting up an AIF?

Prerequisites for registration of AIF Registration || Legal Requirement for AIF Registration

A. Charter document like MOA or Trust Deed or Partnership Deed shall have clauses pertaining to carrying on the activity as an Alternative Investment Fund

B. In case of a trust or partnership firm, the respective Trust Deed or Partnership Deed shall be registered with the respective registrar in accordance with the applicable laws

C. The charter document shall contain provisions prohibiting an invitation to the public to subscribe to its securities

D. The Applicant, Sponsor and Manager shall be “fit and proper” as prescribed in Schedule II of the Securities and Exchange Board of India (Intermediaries) Regulations, 2008

E. At least one key personnel among those functioning in the key investment team of the Manager of an AIF must obtain certification by passing the NISM Series-XIX-C: Alternative Investment Fund Managers Certification Examination.

F. Manager & Sponsor of an AIF shall possess the necessary infrastructure and manpower to discharge its activities

G. The Applicant shall clearly describe the objectives of investment, the strategy of investment, proposed corpus of the Fund, its tenure and targeted investors.

H. An AIF should have a minimum corpus of at least Rs. 20 crores (For an Angel Fund, the minimum corpus has been placed at INR 5 crores)

I. The minimum amount of investment to be brought in by every investor in an Alternative Investment Fund should be INR 1 crore. However, the minimum investment by an investor is prescribed at INR 25 lakhs for Angel Fund.

G. The minimum investment by an employee or director of the Manager of an Alternative Investment Fund shall be INR 25 lakhs or more.

H. It is not mandatory for an employee of the Manager who is participating in the profits to make any investments in the AIF

I. An AIF scheme cannot have more than 1000 investors whereas an Angel Fund cannot have more than 200 investors

J. Category I and Category II Alternative Investment Funds are close-ended funds, whereas category III Alternative Investment Funds are open-ended Funds

K. The minimum tenure for Category I and Category II AIF is 3 years whereas for ANGEL FUNDS the maximum tenure 5 years. There is however a provision for extension of tenure of an AIF which requires the approval of the Unit Holders comprising of at least 2/3rd in value corpus.

L. AIF Regulations restrict solicitation or collection of funds by category 3 AIF, except by way of private placement in accordance with the provision of the Companies Act, 2013 as there is no specific provision for the same in AIF Regulations

M. Units of an Alternative Investment Fund may be listed on stock exchange only after final closure of the fund or scheme, subject to minimum tradable lots of INR 1 crore.

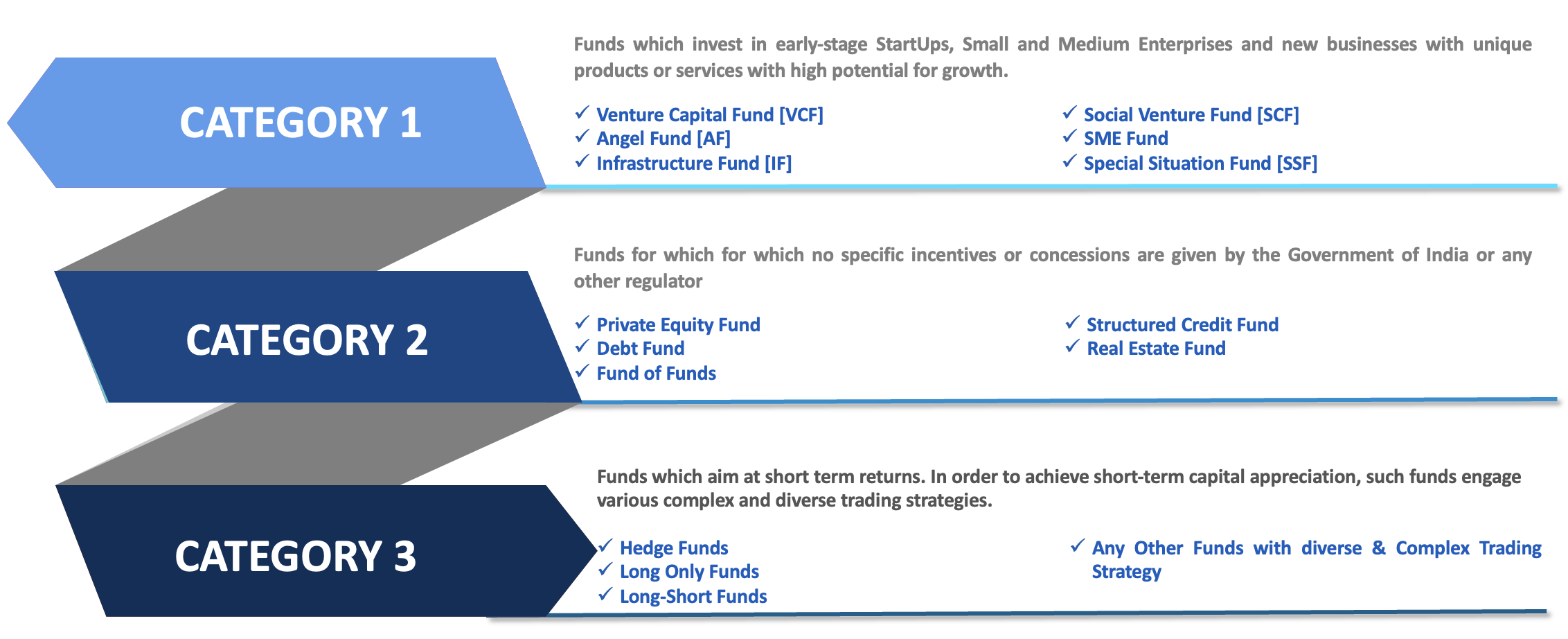

What are the different Categories of AIF?

Category I AIF

Category I Alternative Investment Fund are the funds which invest in economically and socially viable early-stage StartUps, Small and Medium Enterprises and new businesses with unique products or services with high potential for growth. Several promotional and incentivizing initiatives have been taken by the government for such funds due to the growth prospect and employment creation fuelled by such funds. These funds have proved to be very helpful to the startup ecosystem in India.

Category I comprises the following types of funds:

Venture Capital Funds are Category I Alternative Investment Funds which provide funding to startups, early-stage venture capital projects or to a small or medium-sized business, to own a part of its equity.

VC’s generally prefer funding businesses, that are already established or that are in their growth

Comments

Post a Comment